How long does your money last? Are you one of those extremely frugal individuals that hold on to every red cent? Or do you blow your paycheck on Friday every two weeks? Whatever your preference is, you should be saving some of your money for your retirement. Anyone can make money, however, being able to make your money stretch is a super power. Thankfully you have tools like FIREcalc, to help you with your retirement.

So, how does the calculator work?

Honestly just like all the others, in fact, you could probably get the exact results you would with something like cFIREsim. In the case of this calculator, figuring out how to use the damn thing makes it stand out the most. Some calculators are impossibly overwhelming and leave you scratching your head in confusion. FIREcalc takes everything down to a bare bones minimum and gives you what you need…essentially.

It does have a plug and play quality, but if you are not familiar with investing or retirement you will have some trouble. When you are directed to the website you are given a section to add the value of your portfolio and how much you spend. The section also gives allows you to add how many possible years you want to use your money for. Once you submit, an entirely new window is opened with your results.

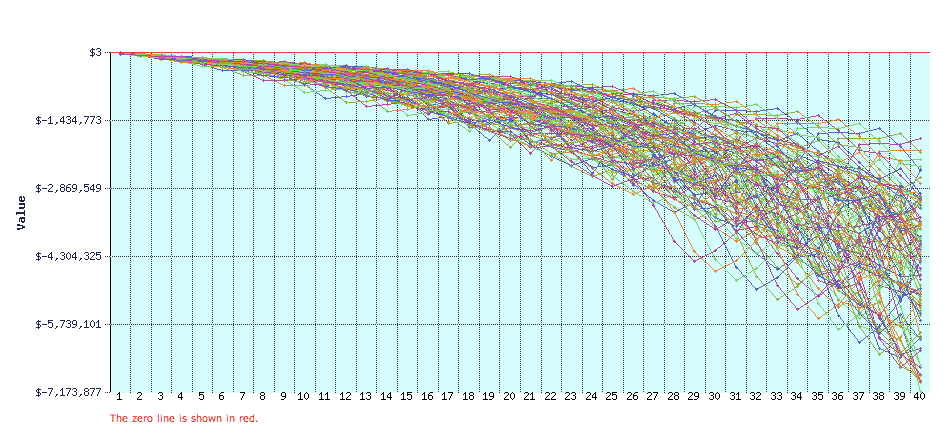

On this page, you are greeted by a technicolor graph of possible outcomes of your portfolio. Other than the graph the calculator is pretty dull. You have a description of how many times your portfolio would fail or succeed. What makes the calculator interesting is the fact that you can see how your money would do during a crash or during a feast period.

There are other tabs where you can add what year you plan to retire or you can take lump sums of your portfolio. If you are unfamiliar with percentages some of these tabs will make your experience a little complicated.

But, what else does FIREcalc have?

Other than the calculator, there really is not much to do with the site. You can add the specifics of your portfolio, but other than that, there really is nothing else. The calculator is a workhorse, a very clunky looking workhorse, but a solid workhorse. This is where many finance calculators fall short. They only have one function. Yes, it is free, and you can use it whenever you need it, but what else can you do?

As far as aesthetics, the calculator takes a page from the old 90’s pop music video playbook. It is really plain. Even the updated version, sporting a cleaner layout and design has little to offer. But FIREcalc does not need all the bells and whistles. The calculator gives you every possible outcome that could happen. When something just works, you do not need to change it often. Too many people want to reinvent the wheel instead of using a solid one. If you want to test the strength of your portfolio, try FIREcalc.